change in working capital formula dcf

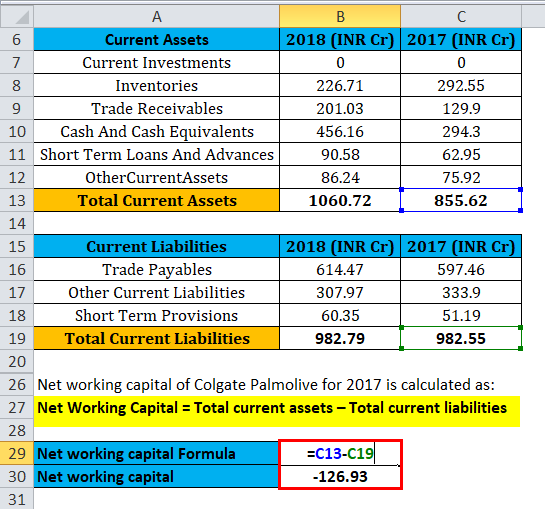

The most common items that impact the formula on a simple balance sheet are accounts receivable inventory and accounts payable. Change in Net Working Capital Net Working Capital for Current Period Net Working Capital for Previous Period.

Negative Working Capital Made Easy The Ultimate Guide 2021

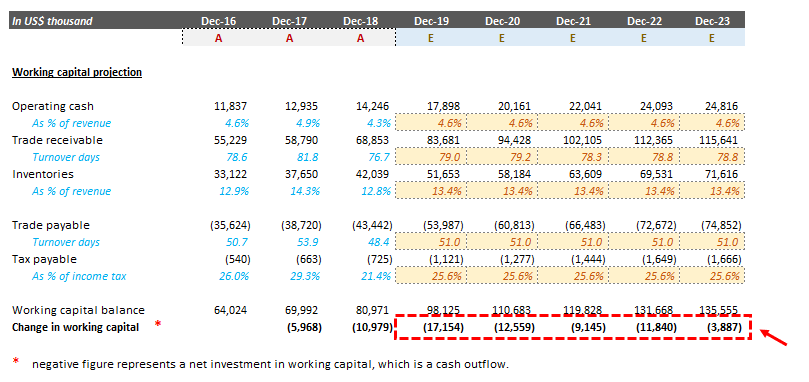

A negative change in working capital working capital forecast to decrease is also possible in certain businesses and at certain times such as when a business is experiencing a downturn in its markets.

. Deduct the debt of last year to find the net asset value. The change in net working capital formula is given as N E B where E is ending net working capital and B is beginning NWC. The logic behind subtracting net working capital is as such.

So if the change in net working capital is positive it means that the company has purchased more current assets in the current period and that purchase is basically outflow of the cash. Thus the formula for changes in non-cash working capital is. Since the change in working capital is positive you add it back to Free Cash Flow.

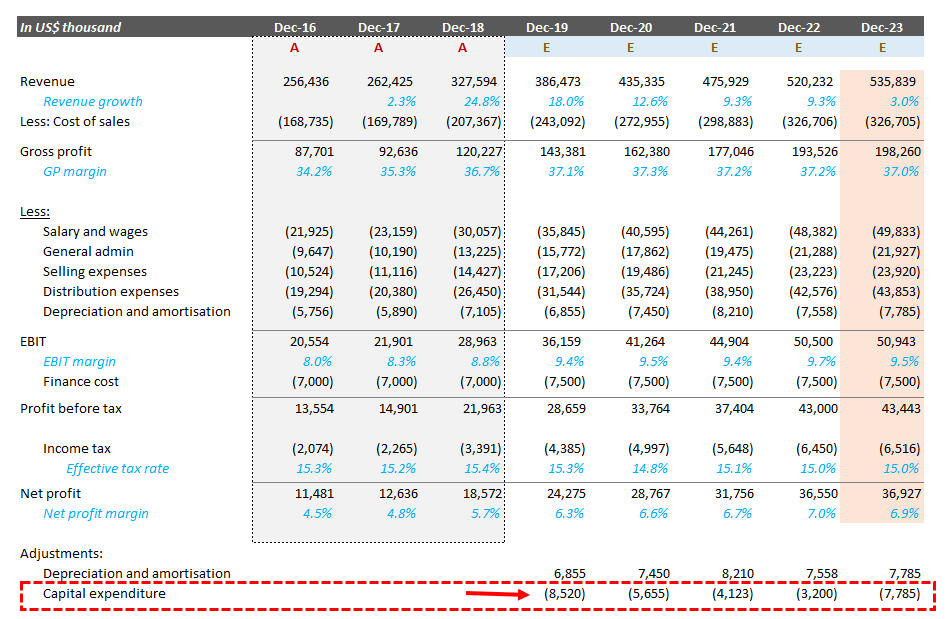

For terminal year capital expenditure please note it should always be slightly higher or at least equal to the Depreciation DA expense. Change in net working capital formula dcf Sunday May 1 2022 Net Working Capital Current Assets Current Liabilities. 8510 x 1772 916697 x 1772 987466 x 1772 1063699 x 1772 1145816 x 1772 1234273 as mentioned above and you might know net working capital enables analysts and investors to.

It means the change in current assets minus the change in current liabilities. The entire intuition behind CA-CL is to arrive at how cash has changed over the period increases in CA use of cash increase in CL source of cash--in that sense you would use non-cash CA - CL to get to FCF to do your DCF. Change in Working capital does mean actual change in value year over year ie.

CF Cash Flow in the Period. Once this is established your question can be answered. If fixed assets depreciate faster then your capital expenditure then in the long-term there will be no fixed assets left in the business.

AP accounts payable. Change in Net Working Capital 5000. It is basically based on methods that will determine how much money the investment will make in the future.

Change in Net Working Capital 12000. Also notice that we have excluded the net cash at the bottom of the cash flow statement. If a transaction increases current assets and.

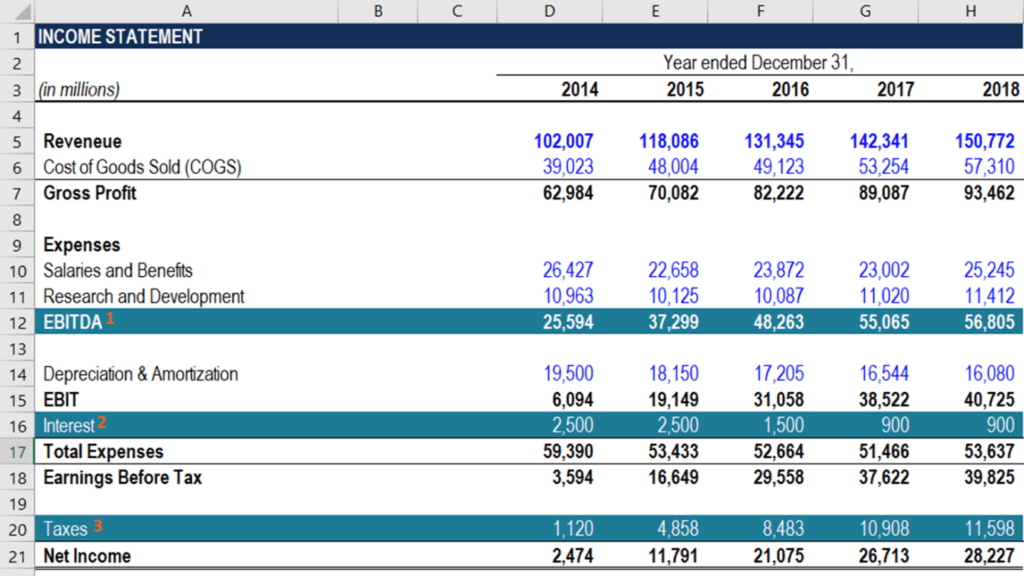

Here are some examples of how cash and working capital can be impacted. DCF is basically used to calculate the present value of the cash flow of the company. The formula for the change in net working capital nwc subtracts the current period nwc balance from the prior period nwc balance.

It can guess the value of an investment based on expected cash flowsIn other words the DCF model tries to predict the value of investment today. Net Working Capital Current Assets less cash Current Liabilities less debt or NWC Accounts Receivable Inventory Accounts Payable The first formula above is the broadest as it includes all accounts the second formula is more narrow and the last formula is the most narrow as it only includes three accounts. The screenshot below introduces you to the file and the assumptions.

DCF Formula CF t 1 r t. Net change in Working Capital 1033 850 183 million cash outflow Analysis of the Changes in Net Working Capital. DCF stands for Discounted Cash Flow.

Because the change in working capital is positive it should increase FCF because it means working capital has decreased and that delays the use of cash. If youre asking whether you include cash in the CA to get to change in net working capital the answer is no. Changes 2017 AR 2016 AR 2017 Inventory 2016 Inventory 2017 AP 2016 AP Where AR accounts receivable.

Raised to the power of the period number. Change in Net Working Capital NWC Prior Period NWC Current Period NWC. It proves to be a prerequisite for analyzing the businesss strength profitability scope for betterment.

Therefore the Change in Working Capital 200 300 100 so its negative and it reduces the companys cash flow. When the company finally sells and delivers these products to customers Inventory will go back to 200 and the Change in Working Capital will return to 0. DCF analysis attempts to figure out the value of an investment.

Answer 1 of 6. Change in Working capital does mean actual change in value year over year ie. Valuation depends upon whether the DCF is valuing cash flows to operating assets or cash flows to.

WACC WACC is a firms Weighted Average Cost of Capital and represents its blended cost of capital including equity and debt. The changes in working capital are discounted using the WCSales ratio working capital over sales which in this case is 80 8510 094. Therefore Microsofts TTM owner earnings come out to be.

Change in Net Working Capital is calculated using the formula given below. Read more in period t. On the right side of the screenshot you can see the magnitude of the error.

The implications of this assumption in a long-term forecast must be carefully analyzed. 18819105991263-13102 19192 34245. Here is an example of the calculations.

Changes in working capital are reflected in a firms cash flow statement. Discounted cash flow DCF is a valuation method used to estimate the value of an investment based on its expected future cash flows. Where CFt cash flow Cash Flow Cash Flow is the amount of cash or cash equivalent generated consumed by a Company over a given period.

With the change in value we will be able to understand why the working capital has increased. R the interest rate. First we have to address a primary assumption on what the DCF is measuring.

1173 x 1772 126356 x 1772 1361 x 1772 146618 x 1772 157937 x 1772 170130. Stable WC Change WCEBITDA EBITDA t terminal growth 1terminal growth. Net change in Working Capital 1033 850 183 million cash outflow Analysis of the Changes in Net Working Capital.

As a sanity check you should confirm that if the NWC is growing year-over-year the change should be reflected as a negative cash outflow and the change would be positive cash inflow if the NWC is declining year-over-year. Here is the DCF formula. R Appropriate discount rate that has given the riskiness of the cash flows.

Calculate the changes in working capital add back DA expense and finance cost as usual. Normalised Cash Flow In Dcf Working Capital Taxes And Stable Roic Edward Bodmer Project And Corporate Finance. This depends on the difference between explicit period growth which is very high in the example and the terminal growth.

Change In Working Capital Video Tutorial W Excel Download

Net Working Capital Formula Calculator Excel Template

Step By Step Guide On Discounted Cash Flow Valuation Model Fair Value Academy

Change In Net Working Capital Nwc Formula And Calculator

Changes In Net Working Capital All You Need To Know

Change In Working Capital Video Tutorial W Excel Download

11 Of 14 Ch 10 Change In Net Working Capital Nwc Example Youtube

Change In Net Working Capital Nwc Formula And Calculator

Change In Working Capital Video Tutorial W Excel Download

Change In Working Capital Video Tutorial W Excel Download

Normalised Cash Flow In Dcf Working Capital Taxes And Stable Roic Edward Bodmer Project And Corporate Finance

Change In Net Working Capital Nwc Formula And Calculator

Solvency Ratios Accounting Education Financial Analysis Project Finance

Change In Working Capital Video Tutorial W Excel Download

How To Calculate Fcfe From Ebitda Overview Formula Example

Change In Net Working Capital Nwc Formula And Calculator

Step By Step Guide On Discounted Cash Flow Valuation Model Fair Value Academy

Projecting Net Working Capital For Free Cash Flow Calculation Dcf Model Insights Youtube